Rather than offer an apology, Scott Morrison has shifted the blame for the robodebt scandal to a welfare principle used by both parties, writes John Maycock.

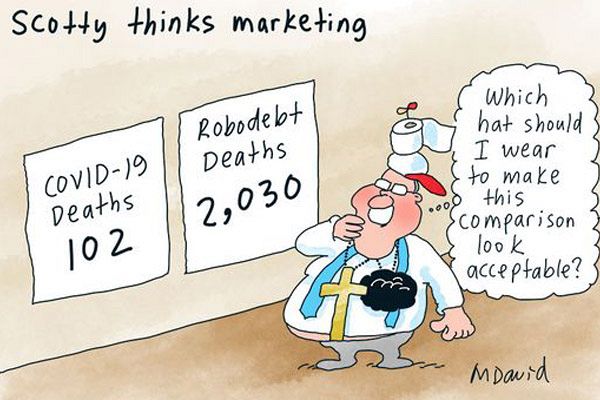

WHEN PRIME MINISTER Scott Morrison, or “Scotty from Marketing”, came out to defend the Government’s robodebt fraud/extortion racket he certainly had his Liar from the Shire hat on — though it could be argued he never takes it off.

Scotty’s defence was a deflection – in my book, technically a lie – declaring that ‘previous Labor and Liberal governments had used income averaging’.

However, I suggest that income averaging is not the core of the issue.

Consider that, according to Bill Shorten:

‘…under Labor it was only ever used as a “red flag”, all “automated interventions” were followed up by human beings…’

Indeed, here is then social services minister Christian Porter in January 2017 defending robodebt:

“It really is an incredibly reasonable process, the question is why wasn’t the previous government, Labor, when they were in charge, engaging in this process.”

Ironically, Porter must have forgotten he had drawn that line between robodebt and the previous Labor processes when in May 2020 he said this:

“In this instance, we used a method that had been used for many years.

…many governments have used ATO averaging… Labor and Liberal.”

Consider, Porter was either lying in 2017 or he and Scotty are being less than honest now.

The issue is not a flagbot (income averaging), the issue is robodebt and the MSM have mostly missed this point. Previous governments may have used flagbots, but they did not use robodebt — which Scotty is tasked with defending.

Why would Scotty want to cop the rap for a flagbot and shift the narrative away from robodebt (apart from the obvious)? Whose idea was it to plug a flagbot straight into robodebt? To remove human oversight and coerce those left doing any manual checking into turning a blind eye to the discrepancies?

Porter was minister for social services when a flagbot was plugged into robodebt full time in July 2016, however the erroneous debts they are owning up to go back to July 2015. It seems that in 2015, they had been sending out robodebts on a more limited basis — perhaps to test the waters, dropping more and more debts without human oversight into the system.

It does appear that estimates of the numbers of possible erroneous debts at the time are based on compliance officer’s samplings rather than audits of all debts raised.

So where does this lead to? Sometime in early 2015, someone was looking at the ongoing upgrading of the previous system where the red-flagged accounts had been assessed by compliance officers for flawed data matching. This is when what would be erroneous debts were filtered out.

Now it seems a flagbot (or an upgraded version) was capable of pushing out 20,000 red flags a week, amounting to millions of dollars in possible (notional?) debts. Consider that although some debts were completely false, it’s probable that most debts were overinflated. However, with compliance checks in place, it was taking a year to generate 20,000 properly vetted/accurate debt notices — and, of course, the number of actual debts and the notional dollar signs fell.

This is where someone ‘keen to push ahead with the automation of debts’ ran into a problem with the new algorithms; the ICT experts’ proposal had included a manual component to the new automated system. Yet ‘ICT rais[ing] concerns of accuracy of the debt calculated if [the] manual step is not included within the process’ suggests that this step was left out. This manual step would likely be compliance checks and here, the answer should have been to recruit more compliance officers in order to achieve more throughout.

However, that wouldn’t suit an ideology wedded to getting rid of public servants — it would cost more while it would still reduce the projected notional debts. Rather, this was seen as an opportunity for some creative accounting, a chance to ramp up the smearing of welfare recipients and to get rid of more public servants. For an ambitious unscrupulous rising star, this was political mileage waiting to be made.

That rising star arrived as social services minister in December 2014, fresh from (apparently) stopping the boats, happy to be touted by the press as coming to stop the bludgers — Scotty from Marketing.

In any case, human oversight was removed and that creative accounting soon showed up in the Government’s fiscal claims, declaring there are billions of dollars being recouped from the bludging welfare rorters.

In December 2015, the Government was defending their MYEFO predicted income of nearly $2 billion due to Enhanced Welfare Payment Integrity debt recovery.

According to Porter, having taken over as social services minister:

“Previous measures that we put in place [were] starting to bear the fruit…”

That would be measures put in place when Scotty (who had by then become treasurer) was minister for social services. This was around the time they started claiming they would save $1.7 billion over five years due to – you guessed it – ‘boosting the department’s… debt recovery capability’.

Then come June 2016 we have this:

‘Just four days out from the election, the Coalition has found $2.3 billion from yet another “crackdown” on welfare recipients and pensioners…’

Now I believe these projected billions in savings (the Government consistently refers to recouping debt as savings) were based on the erroneous robodebts — the money never existed. Indeed, when Alan Tudge was exposed for claiming $300 million had been recouped (in a previous six months), when in fact the number only related to the amount identified as debt, it seems it was probably erroneous robodebts that he was referring to.

Catharine Murphy pinned it down last year:

‘Robodebt was hatched for a simple, clinical purpose: to return money to the budget at a time when the budget was firmly in the red.

Robodebt was about supplying magic billions to the bottom line.’

The trouble is, it appears that a lot of those billions only ever existed on paper.

Then Scotty takes over social services, during which time the creative accounting scam is hatched, before moving on to the treasurer position. For the next four years, the inflated robodebts are used in fiscal outlooks and budgets — persisting in the face of ongoing advice that the robodebts were not just chronically inflated but also unlawful.

No, the crime was not income averaging per se,the crime was plugging a flagbot directly into robodebt. And now Scotty as prime minister gives faux apologies on behalf of the Government while he muddies the waters in regards to the real crime — a crime that appears to have Scotty’s fingerprints all over it.

In the end, the question becomes this: will Scotty from Marketing be brought to justice, or will the Crime Minister manage to lie his way out of trouble again?

You can follow John Maycock on Twitter @L3ftyJohn.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

Support independent journalism Subscribe to IA.