After years of being ignored, the Modern Monetary Theory school of economic thought is escaping its controversial reputation and growing in popularity, writes Dr Steven Hail.

NEARLY 30 YEARS AGO, a New York fund manager named Warren Mosler noticed a discrepancy between what he saw day-to-day in his interactions with the Federal Reserve and the way almost all academic economists write about money. The way they write, you would think currency-issuing governments need to tax before they can spend — Mosler noticed it is the other way around.

Getting this wrong is not trivial. It biases policy narratives. It misleads politicians into thinking that there is something inherently good or sustainable about budget surpluses. It misleads them into worrying about finding the money to meet their commitments when that is the wrong question to ask.

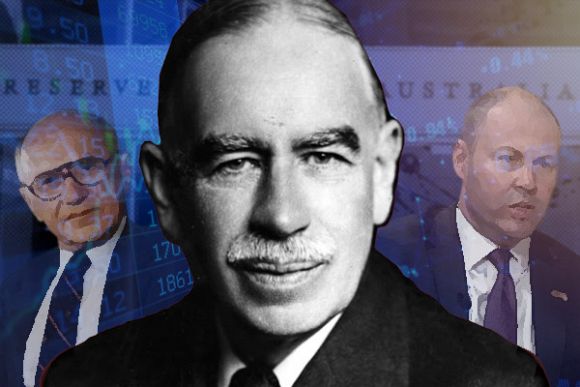

Mosler wrote a book called Soft Currency Economics and reached out to the leading lights of the profession, eventually discovering a group who were interested enough to discuss his ideas. The group called themselves post-Keynesians, although, in fact, they are the modern-day economists who remain closest to the works of the great 20th-century economist John Maynard-Keynes.

Between Mosler, post-Keynesians like Stephanie Kelton and L Randall Wray, and the Australian economist William Mitchell, a new economic school of thought was born, which eventually became known as modern monetary theory (or MMT). For many years, its developers were largely ignored.

This changed after the Global Financial Crisis of 2008-'10 because the tools they had developed allowed them to forecast the nature and scale of the crisis before and with more clarity than almost everyone else. They gained in influence – and you might say notoriety – in the years prior to the COVID pandemic, with Kelton becoming chief economist on the U.S. Senate Budget Committee in 2015. This culminated in her writing the best-selling economics book in the world of 2020, The Deficit Myth.

Since COVID, Kelton's work on the Biden-Sanders taskforce has influenced both the Inflation Reduction Act (2022) and the most rapid recovery from a recession in U.S. economic history.

MMT has come a long way since Soft Currency Economics, with hundreds of academic papers, a variety of texts and debates between a mainstream that claims it is “not modern, monetary or a theory” and proponents who argue that many mainstream economists have never engaged with MMT literature, or addressed and understood the significance of Mosler’s discrepancy and everything that flows from it.

MMT has been widely applied on Wall Street to guide large-scale financial decisions, including by Warren Mosler himself and championed on Main Street by advocates using social media.

Whatever your opinion of MMT, this is quite a story. The tale is well told by U.S. filmmaker Maren Poitras in an award-winning documentary movie entitled Finding the Money, which has been touring film festivals in the United States since September. The movie will be shown in major Australian and European cities in the New Year.

Finding the Money follows Kelton around, as she engages with often sceptical business economists, politicians, journalists and billionaire taxpayers. In between, leading MMT economists explain a variety of policy insights and missed opportunities, drawing on Mosler’s original description of how monetary systems work. The evidence of how and why money was first developed more than 5,000 years ago by early governments is presented convincingly, and Poitras links the emergence and history of money to the nature of government and bank money in the 21st Century.

Perhaps the most shocking sections of the film are those where the director invites leading establishment economists to explain different aspects of the mechanics of monetary systems. That two chairs of the U.S. Council of Economic Advisers and one former member of the U.S. Accounting Hall of Fame are unable to do so, with one of them apparently at one point confusing borrowing and lending, is both confronting and captivating.

All this from something Mosler noticed 30 years ago.

He saw that currency-issuing federal governments always spend – every day – by creating new currency in private bank accounts and that taxes later delete some of that currency from those accounts, rather than tax collections being necessary before governments can spend. Undeleted dollars remain in bank accounts. The national debt is just the dollars the Government has spent into the monetary system and not yet taxed out of it again. It is not the debt of the nation at all. It is dollars in our superannuation accounts.

Amongst the questions that might by now be occurring to you is why a currency-issuing government would ever borrow the currency it issues. In the movie, Jared Bernstein, the chief economic advisor to the current U.S. President, ties himself in knots trying to provide an answer. I could not help feeling sorry for him, but it is one of those unmissable documentary moments.

You can follow Dr Steven Hail on Twitter @StevenHailAus, as well as on Facebook at Green Modern Monetary Theory and Practice.

Related Articles

- If you want to promote democracy, think modern money

- Is a different type of economics the answer?

- A response to MMT criticism

- The MMT government job guarantee

- The facts of Modern Monetary Theory

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

Support independent journalism Subscribe to IA.