An insightful speech by the RBA's deputy governor, intended as a commentary on economic uncertainty, has caused a stir among some who seemed to miss the point. Stephen Koukoulas reports.

A RECENT SPEECH from Reserve Bank of Australia (RBA) deputy governor Andrew Hauser was titled, ‘Beware False Prophets’.

It was an enlightening speech because it laid out a series of what could be called “central banking home truths” which market forecasters, economists and the media regularly overlook when covering the economic and interest rate outlook.

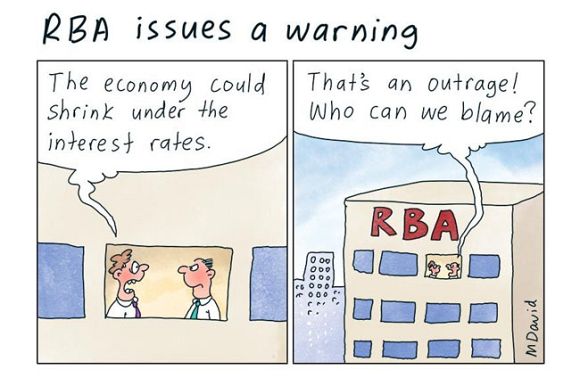

There was something of a fury in how some reacted to Dr Hauser’s speech.

The bulk of the “analysis” boiled down to criticisms of Hauser for bagging private sector forecasters when the record of the RBA in the past decade has been abysmal and in some instances, there were what appeared to be deeply personal attacks of Hauser from some whose forecasting record is “problematic”.

It was a case of throwing stones in glass “Hausers”.

Dr Hauser’s speech sparked a useful and more detailed take on the RBA record, its openness and the thickness of its skin when criticised for its errors.

It was an excellent insight.

Without being too indulgent, it is probable that I was one of the people – of many – Dr Hauser had in mind in his speech of perhaps being a “false prophet”. Over the years, I have been at the forefront of the issues associated with the revamp of the RBA operations via my forensic criticisms of its functioning since around 2016 when it ran off the rails and was unable to meet its inflation and full employment targets.

That said, one thing I would say to Dr Hauser is that my work and research on economics and policy is not intended for the RBA. Unlike the economists of some financial institutions, I have no financial or other implied arrangement with the RBA when discussing those issues. The RBA could offer me a job and no doubt its monetary policy performance would improve if my views were incorporated into its decision-making, but that is not to happen for many reasons including my personal references and other work priorities.

If RBA staff read my research and analysis, which they do, fabulous!

I am helping them to make the right decisions without costing them or the Australian taxpayers a cent.

For me, what may appear to the RBA to be assertive with direct calls on the economy and interest rates is not a reflection of any misplaced over-confidence. I can assure everyone of that.

Rather, that style of writing and speaking is allowing the targets of my work to incorporate those views to, at the margin, structure their corporate, investment and other strategies according to the myriad of views that each receives from what might loosely be called my competitors.

And, of course, my forecasts are always in the context of where financial markets are, not a blanket call where making a forecast for something that is priced into markets, which is next to useless.

Some of the most profitable forecasts are, to the letter of the forecast, wrong. But given where they have been relative to market pricing, have potentially made the most money because markets were mispriced.

If I show too much nuance in my work, that analysis is unhelpful for those for whom the research is intended.

Can you imagine, prior to the Melbourne Cup, the great race caller Greg Miles saying, “I am not really sure who’ll win, it will be among these 15 horses with a 5% chance it will be outside this band of stayers”.

Greg then updates his forecast when there are 50 metres to the winning post.

That last forecast, akin to the “forecast” from market economists a few days before an RBA meeting, is next to useless.

Taking a risk

Investment decisions, business operations and policy decisions are all about risk-taking.

In terms of monetary policy and Dr Hauser’s speech, the RBA's – and everyone else’s – forecasts for inflation, unemployment and GDP growth in the next one and two years will be wrong.

The trick for the RBA is to assess the risks of the direction of the forecast error and as a result, set policy. What are the risks if it holds rates steady, cuts or hikes them?

But all is not lost. If that assessment of risk turns out to be wrong after a policy decision is taken, the RBA can easily adjust policy quickly and decisively to adapt to new and unexpected economic conditions.

Here and now

This brings us back to the current interest rate outlook.

The RBA is close to hiking interest rates again, because of its assessment that the economy is running a bit “hot”, demand is exceeding supply and inflation is taking longer than it would hope to return to the 2-3% target.

Who knows, it might be right this time.

But on the current scorecard, annual GDP growth is 1.1% which is miserably weak. The unemployment rate has already risen by 0.7 percentage points to 4.2%; job vacancies have fallen 27% in the last two years and inflation has fallen from a peak of over 8% to 3.8%. What’s more, wage growth is one of the factors feeding into services inflation is cooling.

And then there is a mass movement to interest rate cuts around the world — what are those central banks seeing that the RBA isn’t?

Indeed, some economists are thinking the RBA needs to hike interest rates three more times which is interesting in the extreme.

My view for some time has been that the RBA has over hiked interest rates which will result in an unnecessarily sharp rise in unemployment and business failures.

Nothing has happened in the economy to make me change my mind.

But given the RBA has hiked rates to 4.35%, the case is overwhelming for rate cuts, not hikes as the RBA is suggesting, starting as soon as possible.

There was a similar story in 2018 and 2019 when the RBA made an error in not cutting interest rates in the wake of high unemployment and inflation below target. I was critical of this stance, calling it inept and an error. This view was correct.

Dr Hauser’s speech was terrific.

But rather than ‘Beware False Prophets’, what about, ‘We would have made better decisions had we listened to a range of credible prophets’?

This does not mean giving attention to the economic snake oil salespeople who may grab the media attention, but rather thinking through what is being said and what is being priced into financial markets.

The RBA does monitor the views of economists, it does a range of business liaisons and, obviously, it is part of the global central bank community.

There seems to be a breakdown in what it may be seeing and hearing and what it does with policy in the context of its inflation and unemployment targets.

Stephen Koukoulas is an IA columnist and one of Australia’s leading economic visionaries, past Chief Economist of Citibank and Senior Economic Advisor to the Prime Minister.

Related Articles

- Interest rate cuts around the world — Australia should join the gang

- Reserve Bank playing with fire — beware of the creeping recession

- Unemployment — the forgotten target of the RBA

- RBA's next interest rate move likely to be a cut

- When it comes to unemployment, the RBA has got it wrong

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

Support independent journalism Subscribe to IA.