Australia is making news worldwide once more due to its crumbling economy, writes Alan Austin.

FRENCH-SPEAKING READERS of the Belgian news outlet RTBF.be were informed last Tuesday about the extraordinary protest by 1,000 Australian engineers – yes, one thousand – who are calling for environmental risk assessment for all Australian construction projects.

Headed ‘Australia: Eminent engineers boycott fossil fuels’, the news item quoted a prominent engineer and reported that two firms have already boycotted the Adani coal mining project.

This story was also reported in the popular French journal Le Soir and the London-based specialist website Environment Analyst.

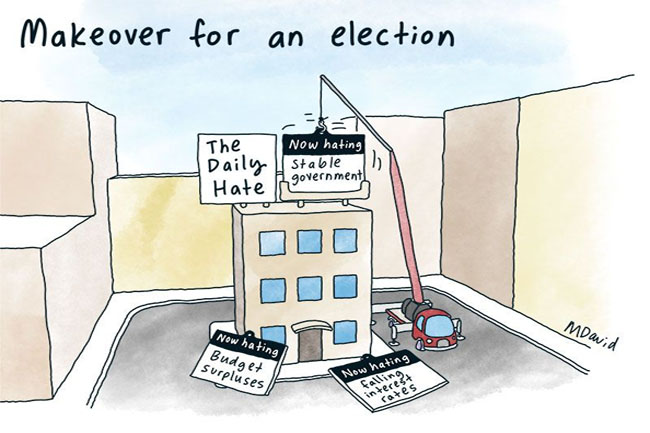

But here's the thing. Unless they are readers of The Guardian, Australians will not have heard or read about this significant development. As far as we can tell, no major news outlet has bothered to cover it.

Australia joins the league of losers

An even bigger story worldwide in the last few days has been Credit Suisse’s findings that Australia is currently the world’s stand-out loser on several measures of wealth.

The French language Nouvelles du Monde (News of the World) headlined its report ‘Le marasme du marché de l'habitation signifie que l'Australie a perdu 124 000 millionnaires’ which translates as ‘Housing market slump means Australia has lost 124,000 millionaires’.

The article reported that:

'The average Australian lost 36 000 USD during the year, according to the Credit Suisse report [and] No country in the world has lost as much as Australia.'

Britain’s Daily Mail headlined its coverage, ‘Revealed: How Australians became $42,000 poorer on average this year — as people in most other developed nations got richer’.

The story noted:

‘As individuals in most developed nations saw their wealth increase, Australians saw the value of their assets dive by $41,758 or $US28,670 ... Collectively, Australia's wealth levels plunged by $645.2 billion, putting it in the same league of losers as Turkey and Pakistan.’

China’s Epoch Times headed its report, 澳洲百万富翁人数大减 全球财富排名暴跌, which translates as ‘The number of millionaires in Australia has fallen sharply’.

Some reports ran Credit Suisse’s short, sharp promotional video, which highlighted Australia’s shame at the 39 second mark:

“The biggest losses in US dollars per adult: Australia."

For the record, these were Australia’s outcomes over the last year, according to Credit Suisse’s global wealth databook:

- The world’s worst fall in mean average wealth per adult;

- The worst decline in house values;

- The worst decline in total household wealth in dollars;

- The sixth-worst decline in total household wealth in percentage terms;

- The greatest decrease in the number of millionaires;

- The greatest loss in mean wealth per adult between 2012 and 2019; and

- The second worst decline in median wealth since 2012, after Norway.

Fortunately, most previous governments have helped build Australia’s impressive wealth, so the economy is still among the leaders on several tables. On median wealth per adult, Australia remains second to Switzerland, although that’s down from first during the Labor period.

On mean average wealth per adult, Australia is in fifth place, behind Switzerland, Hong Kong, the U.S. and Bermuda. This is down from second place between 2010 and 2014, behind only Switzerland.

Credit Suisse’s report includes this chart showing visually Australia’s astonishing demise (the memo in red is ours):

Other outlets which reported Australia’s shame in recent days include the New York Post, Malaysia’s Chronicle, Singapore’s The Straits Times, Spain’s Mundo, Austria’s Kurier, China’s Anhui Hotline, the three Swiss news outlets Handelszeitung, Le Temps and All News, Forbes in the U.S. and Reformation in Belarus.

Specialist journals to cover this include The Urban Developer, France’s Zonebourse and L'Agefi Actifs, the German Swiss Investrends, Greece’s Ναυτεμπορική and Australian and New Zealand CEO magazine.

Earlier negative coverage

This is not the first spate of global bad news stories regarding Australia’s failing economy this year.

Earlier this month, Le Figaro headlined an ominous story, ‘Australia: Interest rate cut to historic lows’.

The cut was required, according to the French daily, because the economy:

‘Which has gone 28 consecutive years without a recession, has seen risks accumulate over the past year with slower growth and inflation, signs of a deteriorating real estate market and rising unemployment.’

All News in Switzerland reported in May: ‘Australia on a negative growth trajectory’.

The analysis, attributed to Bloomberg, explained that Australia's economic growth in recent years has been ‘un miracle économique’ (an economic miracle). But many alarming signs of weakness have appeared in the last 18 months.

The historic resilience was attributed to a combination of economic reforms in the 1980s and 1990s, strong growth in immigration and trade with China. But now, major problems are evident.

Also in May, the French daily Les Echos headed an extremely negative story, ‘Vers la fin du miracle économique australien’ (Towards the end of Australia’s economic miracle).

Stark contrast with the past

All these reports diverge dramatically from the global coverage ten years ago when Australia’s economy was the toast of the economic town.

Just about every accolade imaginable was heaped upon Australia’s extraordinary economic management between 2008 and 2013 – world’s best treasurer; infrastructure minister of the year, world’s highest median wealth according to Credit Suisse; world’s best economy on the IAREM; the highest level of economic freedom in the OECD from 2010 to 2013, according to Heritage Foundation and triple-A credit ratings with all major agencies for the first time.

Plus affirmations from economists, diplomats, national leaders and finance ministers around the world regarding the economic outcomes through the Global Financial Crisis (GFC).

If only Australian voters knew these realities. If only they read the news in Belgium instead of that which is served up in Australia.

You can follow Alan Austin on Twitter @AlanAustin001.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

Support independent journalism Subscribe to IA.