Stolen Australian Government tax policy information was shared between two top-level groups of PricewaterhouseCoopers (PwC) Australia’s controversial “Transfer Pricing” tax division, documents reveal.

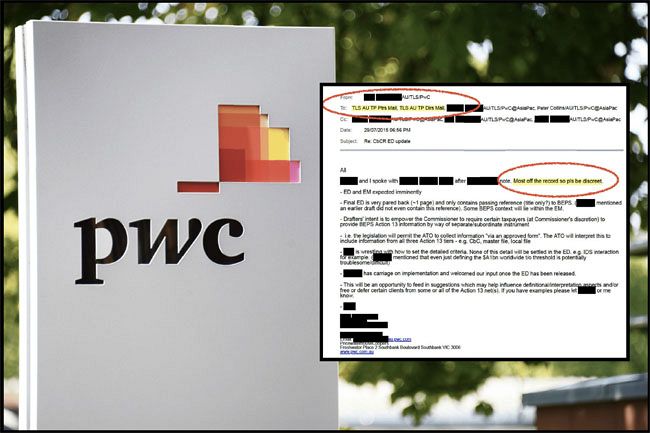

The confidential government data – including key details about yet-to-be-released legislation to stop multinational tax evasion – was shared via two emails, with recipients expressly asked to be ‘discreet’ because it was obtained ‘off the record’.

The emails were sent in late August 2015 while PwC was running its “Project North America” scheme and were sent to both the “partners” and “directors” email groups of the PwC Australia Transfer Pricing tax division.

Contained in the 144-page cache of internal PwC Australia emails at the heart of the tax scandal, the emails disclose key details about new upcoming “country-by-country reporting” (CbCR) draft legislation, being introduced as part of the OECD-led clampdown on multinational tax avoidance.

The emails, from a PwC official whose name has been redacted, disclose what the draft legislation would contain, the timing of its release and even the ‘intent’ of the ‘drafters’ in what powers the new law would give the Taxation Commissioner.

The Exposure Draft “ED” of the legislation and the associated Explanatory Materials “EM” were ‘expected imminently’; writes the author, a PwC official whose name has been blacked out. The final Exposure Draft was ‘very pared back’; and the Government was still ‘wrestling with how to set the detailed criteria’, writes the author, a PwC official whose name has been blacked out.

‘Most off the record so pls be discreet,’ the email states.

The emails are directly addressed to “TLS AU TP Ptrs Mail” and “TLS AU TP Dirs Mail”, as well as to two individuals, including Peter Collins — the PwC tax partner at the heart of the affair.

(TLS, or Transport Layer Security, refers to a standard email security protocol, while AU denotes the recipients are Australian employees, given that PwC operates on a global email network.)

Investigations show at least five partners and directors of PwC Australia Transfer Pricing at that time – including PwC Australia Transfer Pricing lead partner Nick Houseman – are still with the firm, and all remain in those same positions.

All have refused to respond to detailed questions.

Transfer pricing is what multinationals charge different arms of themselves, in different countries, for their own goods and services.

It is often used to avoid tax in a process called “international profit shifting”, where a multinational shifts profits from (higher taxing) countries where they were actually earned, to countries that charge little or no tax (tax havens).

UK-based global anti-tax avoidance group, the Tax Justice Network, defines transfer pricing as ‘a technique used by multinational corporations to shift profits out of the countries where they operate and into tax havens’. It says the equivalent of ‘half a trillion’ U.S. dollars is ‘lost each year to cross-border tax abuse’.

PwC has been caught illegally sharing confidential Australian Government tax information gleaned while PwC partners, including Collins, were providing “advice” on new tax laws to stop multinationals from avoiding Australian tax.

It has been revealed that PwC shared the tax data – which became stolen once it was shared with those not authorised to receive it – within the firm and with clients, including selling some of it for millions to multinationals seeking to avoid Australian tax.

Multiple sources have said the PwC Australia Transfer Pricing division was central to the tax leaks affair and have expressed dismay that it has almost entirely avoided scrutiny to date.

That’s despite PwC two weeks ago, in a carefully crafted and stage-managed operation, announcing the ‘findings’ of an ‘independent review’ and an ‘investigation’ it had paid for, declaring it could ‘now provide a complete and holistic view of what happened, and what went wrong’.

‘People have been held to account,’ wrote new PwC Australia CEO Kevin Burrowes in an “open letter” as part of the operation.

Yesterday that was roundly rejected by the Australian Senate Inquiry into consultancies, which is comprised of members of all major political parties.

Inquiry chair, Liberal Senator Richard Colbeck, said PwC had failed to be “open and honest” about what had occurred.

He said the Senate Inquiry, in its interim report in June, titled ‘PwC: A calculated breach of trust’, had called on PwC to be “open and honest” with the “Australian Parliament and people” as well as with “the international community” about what had occurred.

“I’ve got to say, I don’t see any evidence that that’s what’s going on — other than an attempt to cauterise this whole process,” Colbeck said yesterday.

“Agreed,” said ALP Senator Deborah O’Neill.

Greens Senator Pocock said PwC’s “failure to be absolutely clear about who did what” and to “apply appropriate consequences” was “a major issue for this committee”.

PwC continued to engage in “selective blaming of certain leaders” when “others remain in the firm” and “even the naming and shaming of persons who had nothing to do with the scandal at all”.

Pocock said:

This is a long and repetitive pattern of behaviour from PwC, that people on this side of the table, and many citizens have witnessed, which is to slowly leak out individual names and to fail to properly come clean about who did what within the firm.

Many innocent people have been thrown under the bus within this chapter.

Current PwC Australia Transfer Pricing partners Nick Houseman, Garrick Robinson, Hamish McElwee and Lyndon James, along with PwC Australia Transfer Pricing director Sarah Stevens, all held those same positions in 2015.

None have been named by PwC.

Of the eight partners PwC Australia has said it “exited” over the tax scandal, none were from the Transfer Pricing division.

Of the four other former partners named by PwC in connection to the scandal, Michael Bersten, Peter Collins, Neil Fuller and Paul McNab, only Fuller, who left PwC long before the scandal broke, had been a Transfer Pricing partner.

On 17 July, Tracey Murray, a former PwC Australia Transfer Pricing director who both set up and led PwC’s Brisbane Transfer Pricing office, fronted the Senate Inquiry into consultancies and gave explosive evidence.

Murray blew the whistle because suggestions the confidential Australian Government data had not been widely shared within PwC – and that PwC’s clients did not know the data was confidential – was absurd.

Murray said:

...I just couldn't quite grasp how all the press was happening and people weren't seeing what I thought was quite blatantly obvious.

...from my own knowledge, I know that every transfer pricing partner and director would have had their fingerprints on that.

I know that every Transfer Pricing partner and director would have had their fingerprints on that.

Houseman, Robinson, McElwee, James and Stevens all declined to respond to a series of written questions put to them Monday.

All have been PwC Australia Transfer Pricing partners or directors since at least 2008.

We asked whether they had received the two emails, if they had considered the emails contained confidential Australian Government information and if so, whether they had reported this to any authorities (and if so, which ones).

PwC Australia spokesman Patrick Lane responded:

‘We don’t have anything to offer you for your story. I should, however, caution you that the inferences you are drawing about the group of people you have named are wrong. We will consider your copy carefully.’

We went back to Lane asking what “inferences” he was referring to and what was “wrong”.

He refused to respond.

The internal PwC emails on 28 July and 29 July, discussing stolen Federal Government information, tell recipients that the upcoming “Final ED” (Exposure Draft) legislation ‘only contains passing reference...to BEPS’.

In 2013, the OECD and G20 group of nations announced an “international collaboration to end tax avoidance”.

The OECD said:

‘Domestic tax base erosion and profit shifting (BEPS) due to multinational enterprises exploiting gaps and mismatches between different countries' tax systems affects all countries.’

One component of BEPS, “Action 13”, requires all large multinational companies to ‘prepare a country-by-country (CbC) report’ with ‘aggregate data on the global allocation of income, profit, taxes paid and economic activity among tax jurisdictions in which it operates’.

In Australia, a “large multinational company” is one that has an ‘annual global income of A$1 billion or more’.

Each financial year they must file a “CBC Report” and a “local file/master file”, detailing their Australian financials, in a standardised format.

The PwC 28 July and 29 July 2015 emails are discussing the implementation of Action 13 in Australia.

One of the emails states:

Drafters’ intent is to empower the Commissioner to require certain taxpayers (at Commissioner’s discretion) to provide BEPS Action 13 information by way of separate/subordinate instrument.

...the legislation will permit the ATO to collect information “via an approved form”. The ATO will interpret this to include information from all three Action 13 tiers — e.g. CbC, master file, local file.

The CBC reporting requirements started on 1 January 2016, the ATO says.

The internal email states:

‘(Redacted) has carriage on implementation and welcomed our input once the ED [Exposure Draft legislation] has been released.’

This would be ‘an opportunity’ to attempt to influence the legislation, including to ‘free’ PwC clients of the proposed new laws.

The email states:

‘This will be an opportunity to feed in suggestions which may help influence definitional/interpretation aspects and/or free or defer certain clients from some or all of the Action 13 net(s).’

Anthony Klan is an investigative journalist and editor of ''The Klaxon'. You can follow him on Twitter @Anthony_Klan.

Related Articles

- PwC's Indigenous arm receiving contracts in wake of scandal

- Government secretly axes panel of PwC tax partners

- PwC CEO Luke Sayers quits as charity chair amid tax leaks scandal

- 'Vanished' Tax Board boss was executive at pre-PWC firm

- The PwC disaster — Neoliberalism on steroids

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License

Support independent journalism Subscribe to IA.